Determine rate of return on investment

Plug all the numbers into the rate of return formula. Solution ¼ Year 3 3½.

Rate Of Return Formula Examples How To Calculate The Rate Of Return Video Lesson Transcript Study Com

Other low-risk investments of this type include savings accounts and money market accounts which pay relatively low rates of.

. Click the View Report button for a detailed look at the results. At a rate of 016 per share determine the effective i if after 4 years the stock is sold for 2136 per share. Company Y can determine whether the equipment purchase is a better use of its cash than its other investment options which should return about 10.

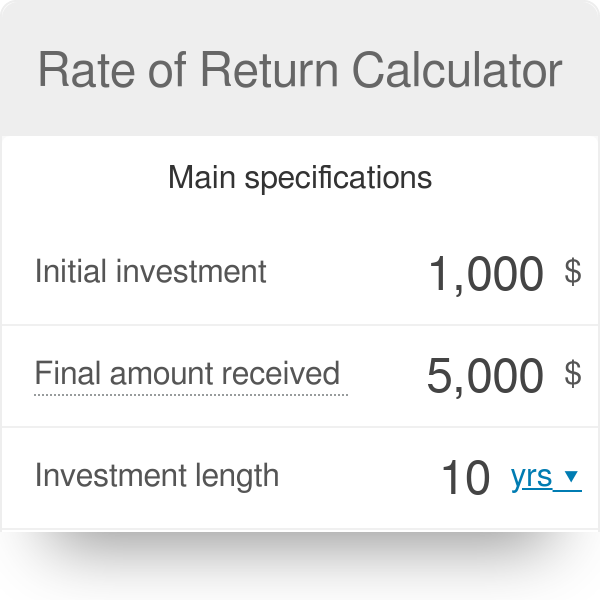

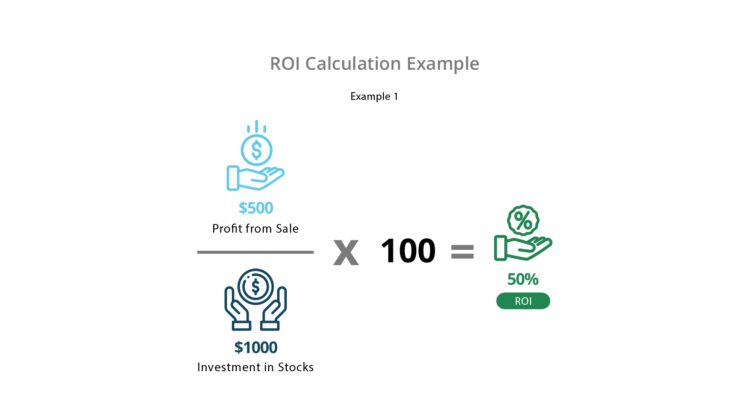

In this case the net profit of the investment current value - cost would be 500 1500 - 1000 and the return on investment would be. This calculator helps you sort through these factors and determine your bottom line. In other words it attains a break-even point where the total cash inflows completely meet the total cash outflow.

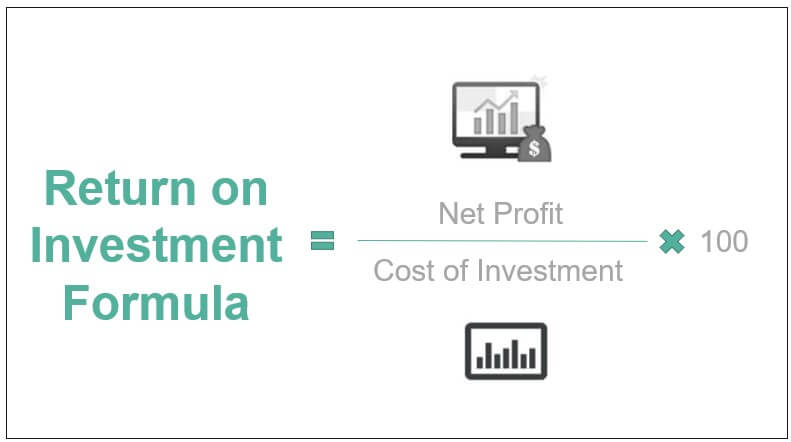

The internal rate of return allows investments to be analyzed for profitability by calculating the expected growth rate of an investments returns and is expressed as a percentage. Meeting your long-term investment goal is dependent on a number of factors. Return on investment ROI How much profit youve made from your ads and free product listings compared to how much youve spent on them.

It comprises any change in value of the investment andor cash flows or securities or other investments which the investor receives from that investment such as interest payments coupons cash dividends stock dividends or the payoff from a derivative or structured productIt may be measured either in absolute terms eg. Find the rate of return for a 10000 investment that will pay 1000year for 20 years. In this case the return on investment would be.

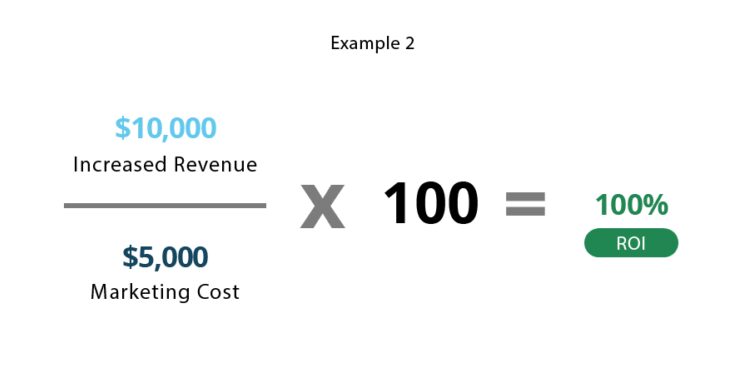

To calculate ROI take the revenue that resulted from your ads and listings subtract your overall costs then divide by your overall costs. A company spends 5000 on a marketing campaign and discovers that it increased revenue by 10000. Our financial experts use internal rate of return examples to teach you how to calculate IRR with ease.

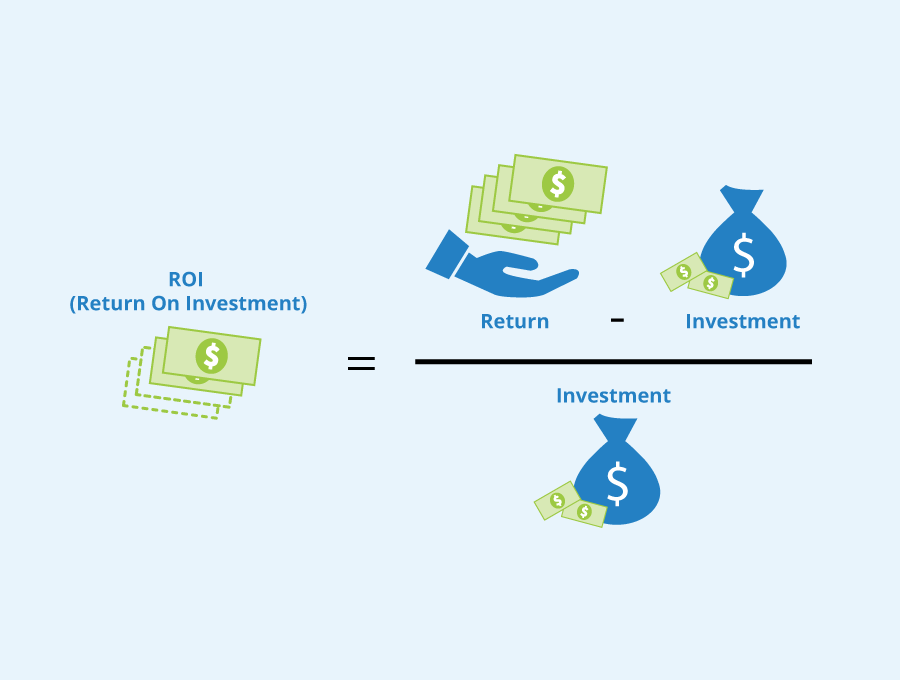

ROI Revenue - Cost of goods sold Cost of goods sold. The investor cumulatively invested 300000 which is 100000 initially plus 200000 in the second month and lost 20000 which is 280000 final value minus 100000 starting value and 200000 of cash flows so the basic rate of return is. In a way it is saying this investment could earn 124 assuming it all goes according to plan.

The nominal rate is the stated rate or normal return that is not adjusted for inflation. Solution 10000 1000PA i 20. IRR is an annualized rate-of-return.

That is good enough. It is known as an internal rate-of-return because the algorithm used does not depend on a quoted interest rate if there is one. In relation to the IRR formula WACC is the required rate of return that a project.

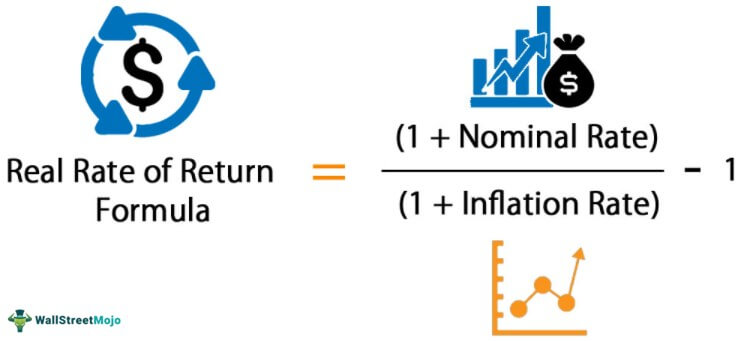

As an example suppose a manager knows that investing in a conservative project such as a bond investment or another project with no risk yields a known rate of. The formula for the real rate of return can be used to determine the effective return on an investment after adjusting for inflation. Internal rate of return IRR is the discount rate at which a projects returns become equal to its initial investment.

Basic Rate of Return. This not only includes your investment capital and rate of return but inflation taxes and your time horizon. Let us stop there and say the Internal Rate of Return is 124.

The internal rate of return is commonly used to compare and select the best project. Normally the longer that money is left in a CD the higher the rate of interest received. Annualized Rate of Return.

The rate of inflation is calculated based on the changes in price indices which are the price on a group of goods. To calculate an IRR one only needs to know the projected. The hurdle rate is usually determined by evaluating existing opportunities in operations expansion rate of return for investments and other factors deemed relevant by management.

Gross rate of return is the total rate of return on an investment before the deduction of any fees or expenses. In finance return is a profit on an investment. Return on Investment Example 3.

First of all the IRR should be higher than the cost of funds. 250 20 200 200 x 100 35. Note that the regular rate of return describes the gain or loss expressed in a percentage of an investment over an arbitrary time period.

The gross rate of return is quoted over a specific period of time such as a month. It pays a fixed interest rate for a specified amount of time giving an easy-to-determine rate of return and investment length. Therefore Adam realized a 35 return on his shares over the two-year period.

Using the Internal Rate of Return IRR The IRR is a good way of judging different investments.

Rate Of Return Definition Formula How To Calculate

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

Average Rate Of Return Formula Calculator Excel Template

Return On Investment Roi Definition Equation How To Calculate It

What Is Roi And How Do You Calculate It Seobility Wiki

Return On Investment Roi Formula And Calculator

Rate Of Return Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Definition Formula Roi Calculation

/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Return On Investment Roi Definition Equation How To Calculate It

Calculating Return On Investment Roi In Excel

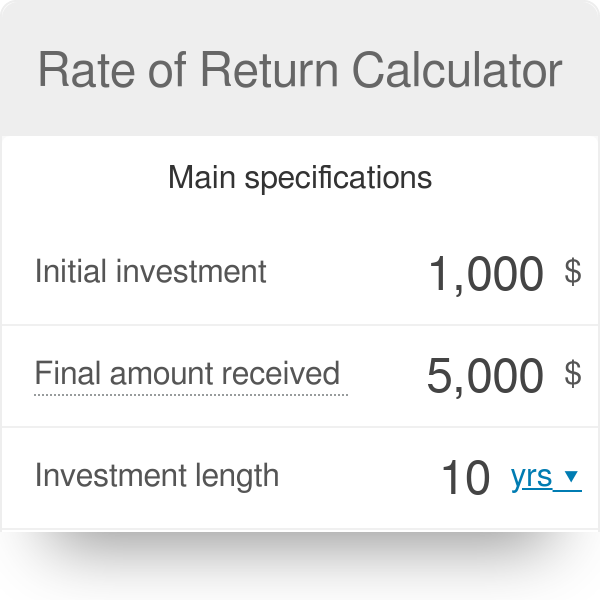

Rate Of Return Calculator

Real Rate Of Return Definition Formula How To Calculate

Return On Investment Roi Formula Meaning Investinganswers

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube